Transfix Take Podcast | Ep. 24 – Week of Oct. 27

West Coast and Pacific Northwest Most Challenging Regions for Shippers

As we reported last week, volume trends are traveling very close to the trajectory we saw in 2020. There was a slight decline heading into last week before volume started to climb back upward. The West Coast and Pacific Northwest remain challenging for shippers. With DAT’s load-to-truck ratios (LTRs) reaching 20/1 — 20 loads for every 1 truck — in most markets in these regions, carriers have a strong upper hand in driving up spot rates. Other regions have stayed relatively flat, giving shippers some fleeting breathing room. Surprisingly, we are seeing a noticeable easing in two large markets on the East Coast: The Elizabeth, New Jersey, and Atlanta markets have cooled, and capacity is shifting to be just a bit more favorable for shippers.

Ports, Ports, Ports

All eyes are on the Southern California ports, after we hit another record number of ships waiting in the San Pedro Bay. September 2021 marked the highest September volume ever for the Port of Los Angeles, AJOT.com reports. “The port’s container volume was 898,941 20-foot unit containers (TEUs) processed, which is up 1.7% from September 2020. The port has been averaging 900,000 TEUs per month for the last 14 months.”

Many supply-chain experts and CEOs have been very vocal in saying that opening the ports 24/7, a move President Biden announced earlier this month, likely will not have much impact on the issues facing the supply chain if the bottlenecks surrounding the ports and the throughput of the overwhelming container volume are not addressed.

Reports say cranes aren’t even running at full capacity during normal business hours, due largely due to the inefficiencies surrounding the ports, including a lack of space and ability to process and move both full and empty containers. Currently, carriers’ chassis and yards are overflowing with empty containers, and drivers continue to face large dwell times when picking up and dropping off containers. Even as they seem to have more luck picking up containers, problems are exacerbated when returning empties, increasing wait times.

Business Insider reports that carriers have had to fill their yards and chassis with empty containers, which prevents them from moving additional loaded containers. Residents near the ports are starting to see empty containers on neighborhood streets. The containers are just one bottleneck, however; transloading and labor issues aren’t helping, either — and this is just on the West Coast. East Coast ports have been taking on more freight and seeing ships begin to anchor at sea.

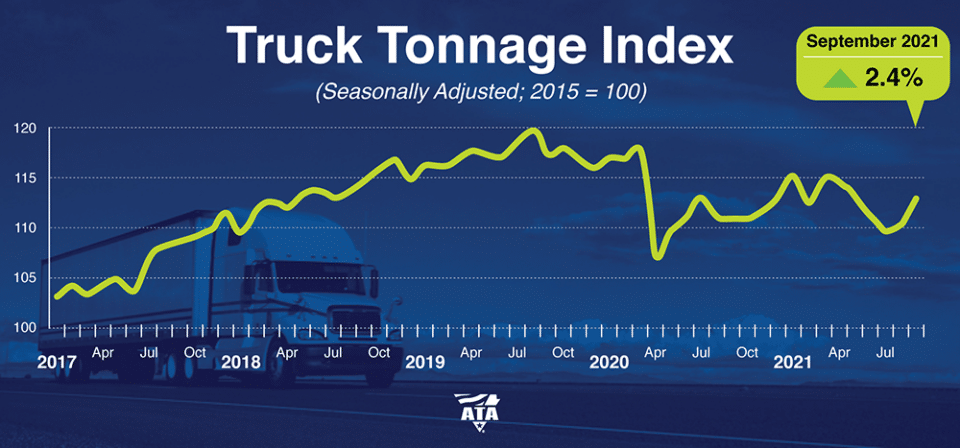

ATA Freight Tonnage Index Up 2.4% in September

The American Trucking Association’s (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.4% in September. The September index was 112.9 (2015=100), up 1.7% over September 2020.

“September’s sequential gain was the largest in 2021,” said ATA Chief Economist Bob Costello. “It is good that tonnage rose in September, but it is important to note that this is happening because each truck is hauling more, not from an increase in the amount of equipment operated, as contract carriers in the for-hire truckload market continue to shrink from the lack of new trucks and drivers.

“The drivers of truck freight, including retail, construction, and manufacturing, plus a surge in imports, are helping keep demand high for trucking services.”

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

This communication may contain certain forward-looking statements that are not statements of historical facts. All such statements are based on current expectations as well as estimates and assumptions that, although believed to be reasonable, are inherently uncertain. These statements involve numerous risks and uncertainties, and actual results may differ materially from those expressed in any forward-looking statements. We undertake no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events, or otherwise.