Transfix Take Podcast | Ep. 34 (Week of Jan. 26)

West Coast Capacity Relief Helps Keep Nationwide Rates Flat

Winter storm Izzy passed through last week with little harm to shippers. Tight capacity in affected regions drove up rates, but overall, freight was still able to move, so rates did not jump as high as they could have, and they even started to ease more quickly than anticipated. On average, rates nationwide are fairly flat. In large part, this is due to West Coast rates continuing a drive downward, with capacity strengthening in favor of shippers, and load-to-truck ratios (LTRs) declining. We expect the same will likely happen through this week. Northeast and coastal markets saw increased rates last week due to the storm, but drivers kept trucking, which led to less of a capacity issue than expected. Through this week, we likely will see these rates deflate — as long as there are no more weather issues. The Midwest remains the hottest market for drivers.

The West Coast is showing favorability for shippers; we haven’t seen this much capacity relief in a while. It is traditional for the West Coast to see capacity easing around this time of year, after imports have cooled down from the holidays. However, there are still more than 100 ships waiting to offload goods to the Southern California ports. Rail lines have increased capacity, and rates via rail have dropped significantly. This could be a large incentive for shippers to choose the rail rather than over the road, as holiday crunch time has passed.

We will continue to monitor the situation in Southern California. In 2021, ports there moved more container units in a calendar year than any Western Hemisphere port had ever moved — 13% more cargo volume than was seen in 2018, the previous record-breaking year, according to Port of L.A. Executive Director Gene Seroka, as reported on DailyBreeze.com.

Future imports are showing signs of weakening, and both the U.S. and China have empty-container issues, but in different ways. Vessels and containers at congested ports are not making their way back to China promptly, which is causing slowdowns and even canceled sailings. Additionally, COVID cases in China bring strict lockdowns, which is affecting not only the ports but also manufacturers. We are approaching Asian Lunar New Year (Feb. 1), which typically closes down much of China for a week.

As of now, even though capacity is tight in general and rates are still high, shippers are starting to feel some relief. On the other hand, carriers are still battling to fill their truck seats with more drivers. Inefficiencies continue to create the need for more capacity in truck transportation due to issues such as driver dwell time and poorly planned shipments. The year may have changed, but not much else has. Carriers are raising pay to recruit and retain drivers, and the government is now stepping in with a controversial pilot program to allow 18- to 20-year-olds to drive 18-wheelers across state lines to support supply-chain demand. This should not affect capacity any time in the near future, as it is a small pilot.

ATA 2021 Freight Tonnage Up .3% YoY

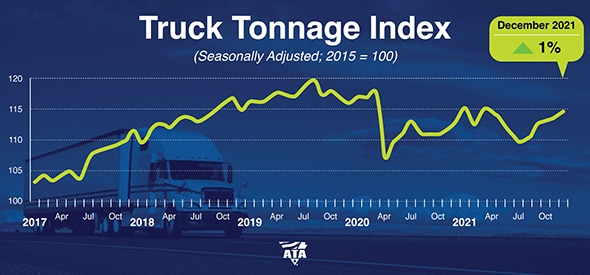

The American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.3% in 2021; 2020 saw a 4% annual decrease. The index increased 1% in December 2021 after rising 0.5% in November. The December index was 114.7 (2015=100), compared with 113.5 in November.

“December’s gain was the fifth straight totaling 4.4%,” said ATA Chief Economist Bob Costello. “In December, tonnage reached the highest level since March, but it was still 2.7% below the pre-pandemic high. This is likely due to the fact ATA’s data is dominated by contract freight. Contractor truckload carriers operated fewer trucks in 2021 compared with 2020, and it is difficult to haul significantly more tonnage with fewer trucks. But overall, we have seen a nice trend up that is reflective of a still-growing goods economy.”

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

This communication may contain certain forward-looking statements that are not statements of historical facts. All such statements are based on current expectations as well as estimates and assumptions that, although believed to be reasonable, are inherently uncertain. These statements involve numerous risks and uncertainties, and actual results may differ materially from those expressed in any forward-looking statements. We undertake no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events, or otherwise.