Transfix Take Podcast | Ep. 66 – Week of September 7

End of Summer, “West To East” Volume Shifts, Early Q4 Indicators

The unofficial “end of summer” holiday is now in the rearview. Now the freight transportation industry has all eyes on the traditional peak retail season of Q4. Over the past two years, we saw Q4 bring a degree of market volatility that tested many shippers– along with just about anyone who worked within the freight industry. The average consumer suddenly became interested in an industry most had been oblivious to, and started paying attention to headlines about things like last year’s congestion at US ports. As matters stand now, it looks like this year will continue to experience issues with port congestion, but most industries in the supply chain– especially trucking– will have a different experience.

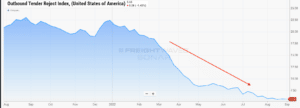

Historically, major US holidays bring disruption to the truckload markets. Holidays routinely bring about periods when carriers reject contract freight. Tender rejections rise, ultimately putting pressure on spot rates and resulting in an increase for carriers. This past week, though, as we closed out summer with the Labor Day weekend, we saw little– arguably none– of that type of disruption. Truck markets have been softening since March, as capacity continues to be in shippers’ favor.

Last week, as we arrived at the end of the month, what we observed was an insignificant and almost unnoticeable increase in tender rejections. Through the holiday weekend, rejections started to decrease again. Last year, tender rejections were above 20% throughout August and September, which put additional pressure on an already-volatile supply chain. This year, rejections have been below 6% since the start of August and have been lower in more recent weeks.

Source: FreightWaves, SONAR

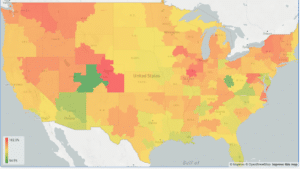

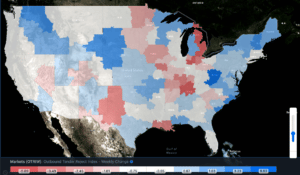

Earlier, I mentioned Labor Day as a turning point, a time when people in freight set their minds to the approach of “peak retail” in Q4. The holiday weekend did shed some light on how impactful peak retail season will be this year. Overall, truckload market conditions seem as if they will continue to favor shippers. We saw little to no movement in most dry van markets through the last eight days. The Northeast seems to be the only notable area that continues to pop out at me.

Ports in the West and East Coast regions remain in the spotlight, as they could create the “dominos” that would potentially fall and disrupt the truckload sector– though I do not believe we will see an impact similar to that of last year.

Rejections in the Northeast have risen slightly, while all other regions have remained flat or declined. The West Coast hasn’t shown any signs of potential strengthening in the truckload sector, but is still seeing potential bottlenecks that may have an impact in the coming weeks. Even as we see some congestion in the Northeast, spot rates remained relatively flat through the weekend and end of month.

Source: Transfix

Source: FreightWaves, SONAR

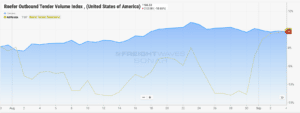

Thankful for Reefer Capacity (?)

Let’s take a look into the refrigerated sector. Markets seem to be picking up some momentum as we head towards the winter months. Unfortunately, produce season overall did not have as prosperous an outcome as refrigerated carriers would have liked to have seen. However, we are seeing momentum pick up as we cruise out of the summer months.

This could hold through the remainder of the year as we roll through the Thanksgiving holiday, which generally gives the refrigerated sector a bump in demand. This comes along with demand that builds as shippers utilize refrigerated units to move some types of dry freight in frigid temperatures.

Source: FreightWaves, SONAR

East Coast Ports Switching Places with the West Coast as They Take More Import Market Share

Areas of congestion throughout East Coast ports are starting to show points of contrast with issues that ports in Southern California managed through last year. These include a backlog of vessels waiting off the coast, lack of chassis, and ports that are overcrowded with containers. East Coast ports have been seeing bottlenecks created by increased volume. This has been driven, ironically enough, by shippers shifting more volume to the East Coast ports in order to avoid the problems on the West Coast.

It looks as if we have only relocated or spread the problem instead of putting a true solution in place. The port of NY/NJ saw a 34% increase in cargo volume in August, compared to pre-pandemic levels. Same song, different coast. We’re seeing problems that are a little too familiar, such as lack of space at ports leading to issues with empty container returns (which leads to a lack of chassis).

And it’s not just happening in the Northeast. The port of Savanna is experiencing the largest backlog of ships, followed by Houston. If this situation continues to worsen, it’s clear supply chains will be impacted. If these issues extend beyond the ports, truckload markets could start to feel pressure again. I do not think, however, that the issue will grow big enough to start impacting truckload markets outside of dryange. Shippers just don’t have the same sense of urgency that they had last year.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.