The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | A Second Potential Rail Strikes Just Days Away

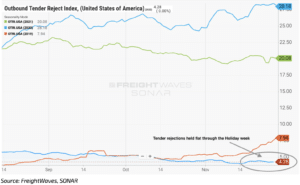

Tender Rejections Remained Flat Thanksgiving Week

Over the Thanksgiving holiday week, it was confirmed just how loose trucking capacity remains. The National Outbound Tender Rejection Index stayed flat at around 4.3%. However, carriers saw a much-needed uptick in spot rates. Although it was only roughly a 3% increase, it still favored carriers and pushed the national average back to the level of early November. Additionally, prices at the pump declined. Driving through December, markets will likely deflate again and experience a slight continuous decline until the year’s final week unless we see disruptions from a rail strike.

All Eyes Are on the Rails: Will We Witness a Strike December 9th?

The last rail strike occurred in 1992, but a strike in 2022 is looking like a greater possibility. Around 30% of freight moves through the US via rail, and if there were a strike, it could upset the freight industry as a whole. Currently, the trucking market is exceptionally soft, with less demand than the previous two years. A prolonged rail strike could turn the trucking industry back into a tailspin, as we witnessed through the pandemic. A rail strike would directly hit the economy and could cost billions per day. In addition, a prolonged strike would impact other industries such as agriculture, manufacturing, fuel, chemical, and more.

Shippers got a breath of fresh air. As of Wednesday, November 30th, there will be two bills put on the house floor to vote. The first is to force the unions to accept the tentative agreements reached in September, while the second is to guarantee seven sick days for the union workers, which has been one of the central disagreements. These bills are likely to pass but have some opposition on both sides of the aisle.

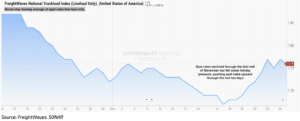

Spot Market Expected to Cool, As Winter Weather Heats Up

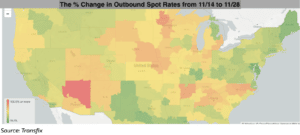

Taking a potential rail strike out of the picture, truckload markets will likely see further softening of spot rates after the slight uptick over the past 14 days. While this uptick was felt most acutely in the Southeast region, most markets experienced some increase. The Northeast was the only region that saw rates decline over the same period.

Winter weather may be the only hurdle left for shippers as we shift into our final gear and start our drive through December to round off 2022. The West and Midwest are experiencing a widespread winter weather event this week that could bring capacity issues to specific markets. Outside of weather, truckload markets will be firmly in the shipper’s control, utterly opposite to how we started 2022 when carriers pushed spot rates to an all-time high.

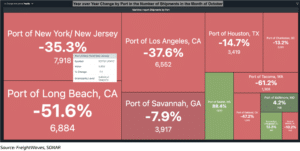

Since March, we have seen spot demand decline for trucking and a return to contract acceptance. Contract acceptance was a result of repricing above spot rates as overall demand started to decrease and the supply chain bottleneck eased. As contractual freight started to be accepted, spot rates began to free fall in March. The year-over-year decline in import shipments at major U.S. ports supports an expectation that shipping demand will likely not change anytime soon. For the next few weeks we should expect to see a similar direction of freight markets as we saw through the first half of November, that is, if a rail strike causes no disruption.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.